Readers, thank you for joining me. Sometimes, I feel a bit mystified by you. For one thing, this blog lacks a central theme other than education, and education has become a sprawling beast, its tentacles wrapped around so many topics that my own blog can make me dizzy. I am not preparing a reliable series of delicious or not-so-delicious crock-pot meals here.

Today, I am straying into finances. I’ve been here before. Sometimes I think I ought to dedicate this blog to finances, but finances bore me. Long ago, in a galaxy far, far away, I was a corporate and municipal bonds analyst looking at a portfolio of municipal bonds that added up to about $500,000,000. I prefer writing. I prefer teaching. Heck, I’d prefer being a barista. Still, I have to stray into finances today.

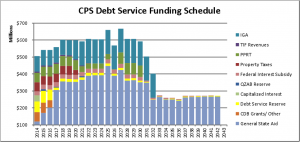

The following chart offers a potent example of the problem. Admittedly, Chicago has become a financial black hole, but the same can be said of Detroit, with Los Angeles is not running far behind. Many school districts are digging holes by floating bonds and surviving with the aid of loans that will eventually have to be repaid. Parts of Michigan have become genuine financial wastelands. From the CPS article, “Chicago Public Schools Fiscal Year 2015 Budget” at http://cps.edu/FY15Budget/Pages/debtmanagement.aspx: \

(Click on graph for better view.)

(Click on graph for better view.)

The above graph shows debt service payments for outstanding CPS bonds, money owed to bondholders. The graph does not include any impact from future bonds issued to further support future capital budgets, such as the $800,000,000 bond that CPS wants to issue next year to cover the next year’s financial challenges. General State Aid and PPRT (Personal Property Replacement Taxes) are among the revenues used to pay bondholders. GSA and PPRT revenues needed to fund debt will increase significantly – from $247 million in FY15 to $434 million by FY17, staying at approximately the same level through 2030. Money used to pay off debt holders is directly taken away from possible instructional and other immediate uses.

For this year, Heather Gillers, Chicago Tribune, reported that on February 3, 2016,

“Chicago Public Schools managed to borrow $725 million Wednesday by promising investors extraordinarily high interest rates.

Bonds issued by taxing bodies like CPS are normally considered sound investments, but that’s not the case with a school district weighed down by debt, labor uncertainty and political tumult, one market analyst said.

“This is not a typical municipal bond,” said Matt Fabian, a partner at Concord, Mass.-based Municipal Market Analytics. “You can’t go into it assuming that you know what’s going to happen or that you will almost surely get your money back. There is a large degree of speculation.”

Documents released early Wednesday afternoon show CPS sold 28-year bonds at yields of 8.5 percent. Before the district pulled its bond issue last week, it was offering 25-year bonds at 7.75 percent. By comparison, when the state of Illinois sold bonds earlier this month, yields were 4.27 percent for 25-year bonds.

Bond issues are made up of individual bonds that mature at different times. Borrowers pay higher rates on bonds that mature in later years.

Moody’s Investors Service rated this bond issue four levels below junk bond status. That’s why the interest rate has to be so high. When risk is high, return has to be high or people do not invest. What is the risk? CPS may have to default on these bond payments to bondholders. The Chicago Public Schools are broke, broker, brokest — and have been for some time, which is what these bond issues are about. Another risk that Chicagoans are running — and many do not know about the landmine underneath their schools — is that law requires large tax increases if CPS cannot meet its obligations with funds available.

Using debt to fund schools will not solve CPS’ long-term financial crisis. The district is only digging itself into a deeper hole, spending money to borrow money. Millions of dollars are slated to pay for borrowed money — millions that cannot pay for teachers, schools and educational supplies.

Eduhonesty: As the election comes near its close, I thought I would take today to emphasize that politicians promising to provide all the services to all the people are simply lying. Bills come due, even for governments.