“Well, maybe it will work.” That’s what I expect counselors and teachers are thinking when they advise marginal students to go to college. “If he just works hard enough…” or “If she gets enough tutoring…” We hope for the best. For one thing, teachers and counselors want the world to offer equality of opportunity to their students, and discrimination screams from between the lines of any college application.

These posts I have been writing? They don’t apply to my own children. Both are debt-light. We paid for those undergraduate college educations. We are not paying for graduate school, but the younger one has a teaching assistantship and tuition waiver, while the older one will end up owing maybe $20,000 for a Harvard Master’s degree. Because she had been on her own and working as a teacher in a low-income district for a few years, the university blessedly looked at her income, not ours, in calculating financial aid. My daughters’ friends have mostly all gone to college on the family dime and those kids are starting adult life free and clear.

So we look at some of our challenges, our kids who qualify for free and reduced-price lunches, kids with dreams but limited academic prowess, and we say, “Here are materials for the college fair.” We talk to kids with frighteningly poor study skills, kids with bloodshot eyes who are squeaking by on the basis of adequate test scores that might have been excellent if they could or would have read their textbook, and we say, “I expect to see you at the college fair next week.” We push. We push because we want to rescue these kids, to somehow set them on the track to the middle-class life we want for them.

If college were free, that attitude would work fine. But college costs buckets of money. More importantly, college calls for a commitment of time and energy, and many high school graduates are unready for college. Those students who love to listen to Snoop Dogg and Wiz Khalifa may not be ready to sign on too many dotted lines. The Young, Wild & Free should not be going into debt until they have lived on their own for awhile and tried to survive on minimum wage or a few dollars more. Their odds of success will skyrocket once they have been rescued from losing their apartment by a refund check, lost a job because the car died, or simply realized that the money they are earning will never buy the lifestyle they desire.

Let’s think about what this eminently listenable song means for a kid’s college prospects: “Young, Wild & Free” (with Wiz Khalifa) (feat. Bruno Mars)

A modicum of reality should be offered up to our students before we get them to fill out their application papers and loan forms. We need to tell our students the truth. Counselors and teachers share fun stories about college and statistics about the financial advantages of a college education. But too often, we only share the upside. Too few of us risk discouraging students, even when those students should be discouraged. No one wants to rain on a dream.

At the very least, though, we should sketch out a realistic picture of costs and benefits for students so that they understand what they are getting themselves into. A kid can only live so young and wild and free and still manage to graduate. Financially, that first, big adult adventure can carry a long shadow. Student loan debt represents years of financial indentured servitude. The graduation numbers are truly daunting, too.

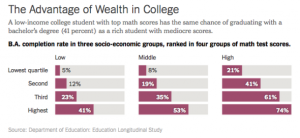

What we want to be true should not be confused with the truth. The truth is that our middle class and upper class students go off to college with academic advantages, and often with the possibility of graduating debt-free. Middle class and upper class students are more likely to get their degrees. These financially-advantaged students with fewer or no loan dollars to pay back are more likely to get the benefits that come with college graduation. They are also more likely to be ready to tackle the majors that pay big money, such as engineering or computer science. (That’s another post. Lack of STEM teachers and computers in poorer districts create part of this inequity.)

Eduhonesty: I offer free tutoring to students who try to make the college leap, extra hours of math or English remediation and support. If we want to help, I think tutoring students who find themselves in over their heads may give these kids their best chance of succeeding at higher education. If we are going to push marginal students to sign on those Perkins dotted-lines, we should be prepared to stay in touch and help them as they navigate the unfamiliar waters of college.